Rising Loan Repayment Rates; 2.2 Million American Homes At Risk ...

Remember this old joke?

Remember this old joke?The one that goes 'If you hang onto that old outfit for long enough it'll be back in fashion -- some day'.

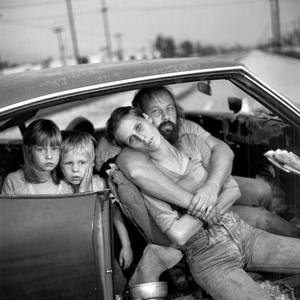

Well, it seems the same thing could could be said about old black & white photographs. Such as the one shown above - as well as the one at the bottom.

But before you get that far, here's one of today's (several), harrowing headlines.

As rates soar, 2.2 million Americans risk losing homes this yearPhew.

That certainly sounds like one hell of an awful lot of people.

So, here's something we've snipped regarding just one of those 2.2 million people's present day, personal stories.

... a 47-year-old assistant optician, was tempted to take out a special high-risk loan targeted at people with low credit ratings.Uh, oh.

Today her monthly repayments have soared to 2,800 dollars, yet she only takes home 1,600 dollars.

She is among 2.2 million people across the US who risk forfeiting their homes by the end of the year as they struggle to meet monthly repayments swollen by rising interest rates, and triggering fears that a financial crisis could sweep US lenders.

Talk about trouble brewing;this type of terrible, trouble.

" ... I'm panicking every day.We don't damn well doubt it, dear.

I'm not sleeping because I'm worrying.

This house has been in my family forever and I don't want to lose it.

But I can't make the payments they are asking me for," she told AFP.

Especially not in view of the fact that this type of horrible hype was used so successfully for so long to sink so many hooks, so securely into so many unsuspecting trusting souls.

"Blinded by their own greed and the incredible amount of money that was being provided by Wall Street, mortgage companies were making loans that were abusive," agreed Ira Rheingold, of the National Association of Consumer Advocates which has taken up Edwardsen's case.Just another sign of these twisted times?

Some companies were filling out false applications to ensure the credit was agreed. In Edwardsen's case, she became a doctor with a monthly income of 6,000 dollars.

"They were making loans and they knew people couldn't afford it and they made them anyway," Rheingold said, blaming "greedy deregulation, failure of the government to intervene and Wall Street's incredible appetite for high risk bonds that would pay them a lot of

money."

Last week as the shaky mortgage market dragged down the US stock market, US financial authorities toughened up conditions for approving such high-risk loans.Oh, we see.

But for some, the move comes too late.

Too late, eh?

Well, they got that right.

Read the rest of this report and see if any personal alarm bells should be ringing.

Blogroll Me!

Blogroll Me!

8 Comments:

you know what they say about fools and their money

they should make intelligence tests mandatory for would be borrowers

A few months ago I saw a British documentary on the same phenomenon in Britain. Poor people who don't qualify for credit through the charter banks are being gouged through the eyeballs by finance companies that offer small loans for ridiculous amounts of interest. Many people default on these loans or go bankrupt.

On the other side, Barclays and the Royal Bank of Scotland, to name only two, routinely offer clients more credit than they can afford to pay back. I wish I could remember the name of the show, it was very good.

Lesley, the name of the worst 'loan shark' offender [by far] here in the UK is PROVIDENT finance.

They specificaly target the most needy and vulnerable. Their annual profits are obscene.

Thgeir agents prowl the streets of the poorest areas and sell their 'services' on the doorstep.

it's called usary and it's been around a long time .... remember the upturning of the money men's tables .... in the temple?

HE had it figured out 2000 years ago .... sadly no one else has been able to change things either ... in over 2007 years

Things have been headed this way for a long time. Here in UK the income figure used by lenders to assess abilty to repay has been creeping up from the long time norm of 2.0 to 2.5 times annual income - to a now ridiculous 5.00 multiple. Talk about disasters waiting to happen.

It's a scandal. The lenders have been actively ensnaring the gullible and inexperienced. The lenders can't lose. If you pay, you pay through the nose. If you don't\can't they kick you on the street and reposess. I worked in finance for many years and could tell you about real horror stories.

Including plenty of suicide stories.

That is definitely a sad story Richard. However this 'bubble' is only the latest one to be threatening to burst by overborrowing, (which has been induced by prior 'easy' credit), and other indulgences and carelesness. Although it might be tempting to ridicule or taunt the Americans for their plight, for they never learn, even from their own hard experiences, in this instance I feel more sorry for them, than anything else. Basically the whole system has conspired against them, and betrayed them.

Let's start with the American Public Education, which have been promoted to be established around the turn of the 19th and 20th centuries by such 'Heros of Democracy' as Rockefeller and Carnegie. By now this so called 'Educational System' has grown into a disfigured, and bloated monster. This institution has time for indoctrinating the masses about all sorts of 'politicaly correct' and conformist projects and agendas, for the purpose of making impressionable young people followers and order takers for the rest of their life, (beside the ever diminishing basic curriculum), but never for such important practical things to teach them how a thoroughly commercialized society like the United States works, including its credit and banking system.

No wonder, that large portion of American society is lacking even basic financial skills, ranging from budgeting and how to save money, to de-coding inducements and resisting psychological manipulations in advertisements, plus such phenomenons how credit, like 'easy payment' works, including the cost of borrowing, amortisation and so on. The end result is people, who inspite of working the longest hours, and taking second jobs, are still only inches away from total financial ruin with all its attendant stress for themselves and their families, never enjoying security and peace of mind in their life.

In other word, they are hardly more than sheeples to be slaughtered by an exploitative system, which saturates their every waking hours, the surrounding physical space and airwaves with so called 'commercial talk,' which is elevated to a scientifically researched level, including subliminal messages.

One thing is certain: This system is designed to eventually collapse the host society, after much suffering and exploitation.

To my American brothers: When that happens, all you need to do to break the chain of debt-slavery is to write off all debt, (public and private) without any compensation to the creditors. Furthermore, confiscate all ill gained and hoarded wealth of the monopolists and money lenders, (including all their personal 'hard assets'), and finally chase away and bar them to ever return again.

(Thanks Frank. You beat me on that one.)

PS Other Western countries differentiate themselves from the Americans, by only the degree of their indebtness. We all facing this plague, in slightly different degree.

here's the lowdown on Canadian debt, as of 2004:

Average Canadian household debt in 2004 through personal loans, lines of credit and mortgage debt: $69,450.00

Estimated household debt (mortgage and credit debt) owed by Canadians in 2003: $731 billion

Estimated household debt owed by Americans: $8.4 trillion

Estimated personal savings by Canadians: $9.39 billion

Estimated personal savings by Americans: $191 billion

Standard credit card interest rate (average): 18.9%

Canadian household-debt-to-income ratio in 2003 (household credit as a percentage of disposable income): 105.2%

Canadian household-debt-to-income ratio in 1983: 55%

Percent increase in private bankruptcies in Canada since 1966: 13.3%

Average Canadian student debt, among those who borrow and graduate from four-year programs: $22,700

Percentage increase in Canadian credit card debt between 1997 and 2001: 90%

P.S. Bloomberg has an excellent series on subprime loans and housing declines. Courtesy of TBogg.

Post a Comment

<< Home